Fast, flexible, and secure banking

Go from same-day payment to payment in minutes with a LoadPay™ bank account.

Get started with LoadPayFast, easy, and secure

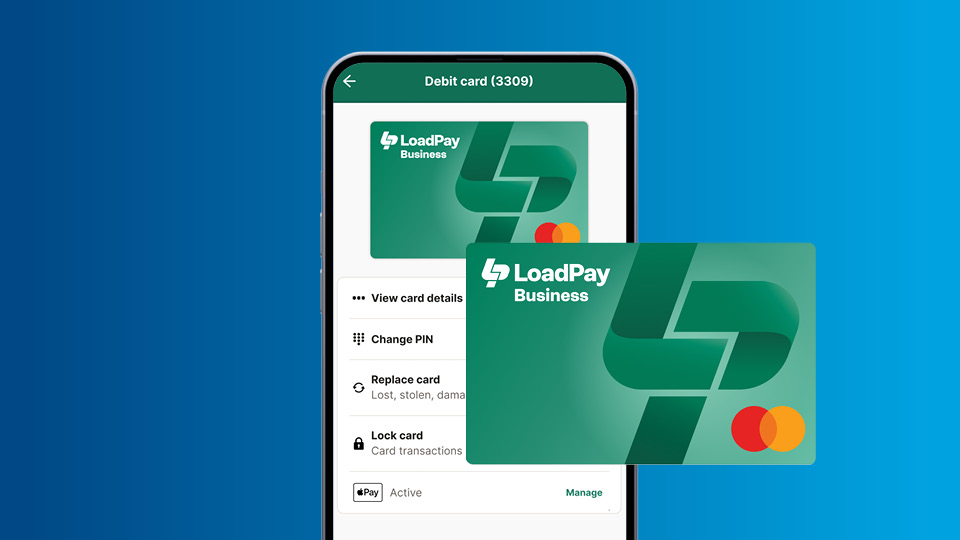

Get your load payment funds in one place. With LoadPay™ bank account and debit card you get:

Payment in minutes

Get paid even faster—no waiting for checks, bank hours, or slow ACH transfers.

Anytime access

Access your funds 24/7/365, without being restricted by traditional bank hours.

Spend anywhere

From fuel to fries, use your LoadPay debit card wherever Mastercard® is accepted.

Streamline finances

Easily view your business expenses and invoice payments all in one place.

Driver expenses

Control driver costs with debit cards equipped with spending limits and fraud monitoring.

Cash advances

Get added flexibility with C.H. Robinson cash advances deposited directly into your LoadPay account.

Your money, ready when you need it

Use your LoadPay debit card anywhere Mastercard® is accepted. Get invoice payments in minutes and access your funds instantly for fuel, repairs, and anything else to keep your business moving.

Get startedManage driver spending with expense cards

Managing finances for your trucking business shouldn't slow you down. Business expense cards are designed specifically for truck drivers and fleet owners. Paired with a bank account built for the road, they help you avoid lost receipts, delayed reimbursements, or budgeting headaches. They’re your solution to smarter, faster expense management.

- Get real-time expense tracking

See every fuel stop, repair, or meal instantly in your account dashboard. No more surprises at the end of the month. - Manage multiple drivers with ease

Need more than one card? No problem. Issue and manage multiple business expense cards right from your bank account. - Set spending limits and controls

Easily control how much each cardholder can spend. Ideal for drivers, dispatchers, and office staff. - Automate reporting and reconciliation

Receipts and spreadsheets are a thing of the past. Your expense data is automatically categorized, saving you hours of admin time. - Rely on built-in security features

Lost a card? Lock it instantly. Your funds—and your fleet—stay protected.

Success stories

A carrier had an invoice approved late on a Friday afternoon and it was available in their LoadPay account in minutes. Prior to LoadPay this payment would not have been processed until Monday at the earliest and would likely have hit their account Tuesday morning. LoadPay shortened a four-day process into minutes.

A carrier opted to QuickPay an approved invoice and it was available to be spent in the LoadPay account within 3 minutes.

Frequently asked questions

When it comes to hauling for C.H. Robinson, you have questions, we have answers.

Q: What is LoadPay?

LoadPay is a digital bank account specifically designed for truckers. It enables carriers to get paid in minutes on approved invoices 24 hours a day, 7 days a week, even on weekends and holidays.

Q: Is there a LoadPay app?

There is a web-based LoadPay app where clients can manage their entire wallet, including reviewing transactions and accessing debit card and account information.

Q: How does LoadPay benefit me if I’m already getting paid fast?

The biggest incentive for carriers to sign up for LoadPay is the upgraded payment experience, which includes benefits like:

- 24/7, 365 funding: Carriers can get invoice payments and use funds anytime without waiting for traditional banking hours.

- Save on ACH & wire fees: Since funds sent to their LoadPay checking account are available to spend within minutes, clients no longer need to pay a wire fee to expedite payment. Additionally, C.H. Robinson® Factoring by Triumph and TriumphPay do not charge carriers to send funds to a LoadPay account.

- FDIC Insured: Funds in their LoadPay account are eligible for FDIC insurance just like any other bank. The standard insurance amount is $250,000 per depositor, per FDIC insured bank, for each account ownership category. Learn more about FDIC insurance here.

- Anywhere MasterCard® is accepted: Carriers can pay for all the things they normally spend money on like fuel, repairs, and bills.

- Easily accessed: Carriers simply choose LoadPay from the list of funding method options on the C.H. Robinson Factoring by Triumph portal when electing their payment method.

Q: Is LoadPay accepted everywhere?

Yes, it is accepted everywhere Mastercard is accepted.

Q: How do carriers make purchases with LoadPay?

LoadPay offers several ways for carriers to spend their money:

- Physical debit cards: Carriers can order a LoadPay debit card which can be used just like any other debit card where MasterCard is accepted. Allow 5-7 business days for shipping.

- Virtual debit cards: Carriers will have immediate access to card information that they can use to make purchases online.

- Digital bank account: Clients can add their digitally-enabled bank account to their digital wallets like Apple Pay, Google Pay, and Samsung Pay and use it immediately.

- ATM Withdrawal: Clients can withdraw cash from ATMs across the country just like any other checking account.

Q: How do I transfer money to and from my LoadPay account?

Money can be moved from LoadPay to most external bank accounts via ACH transfer, just like a regular checking account. LoadPay does not charge a fee for incoming or outgoing ACH transfers originated at other banks.

LoadPay will process an outgoing ACH transfer in 24 hours. However, it will take additional time for the external bank to clear the transfer and make the funds available.

Generally, larger banks clear payments faster, sometimes within 24 hours. Smaller banks are slower to clear payments and can take 3-5 days.

Q: Is LoadPay free to use?

There is no charge to apply, no account minimums (although we may offer deposit-based incentives), and no monthly service charge for the LoadPay Business Debit Account.

Q: How do I sign up for LoadPay?

Visit this link to get started.

Q: Who can I contact about LoadPay?

Contact [email protected] if you have questions about getting started with LoadPay. If you are an existing LoadPay carrier and have questions about your account, please visit https://loadpay.com/support or call 1-800-850-8234.

LoadPay is a product offering of TBK Bank, SSB, Member FDIC. The LoadPay debit card is issued by TBK Bank, SSB pursuant to a license from Mastercard.

Factoring products and services are offered by TBK Bank, SSB d/b/a C.H. Robinson® Factoring by Triumph.