U.S. politics and global delivery

Analysing the potential shifts in freight and infrastructure due to the new administration

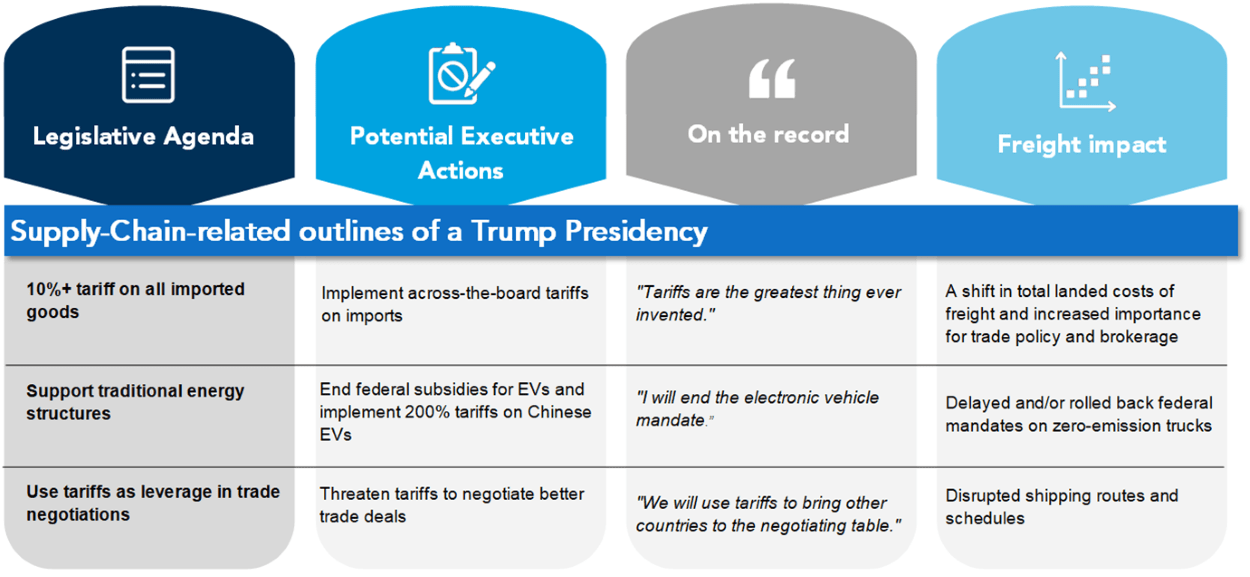

On the record quotes pulled from various sources, including Time Magazine (29/10/2024) and The Atlantic (19/10/2024).

President-elect Trump has indicated that his supply-chain-related policy agenda will be centred around “de-risking” from China and other foreign manufacturing centres, along with rolling back or eliminating renewable-energy mandates. This approach would lead to higher tariffs for all imported goods and potentially significantly higher tariffs from China.

This in turn could lead to shippers seeking to “de-risk” from China and pursue alternatives in routeing based on increased production in nearshoring, friendshoring or ally-shoring origins. Supply chains will have to work closely with their financial departments to assess the impact of higher tariffs on cash flow and carrying costs.

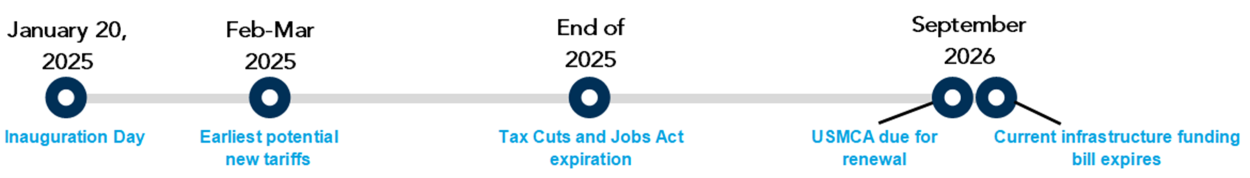

The earliest that new tariffs could be in effect is late February or early March. With continued port labour uncertainty and the potential for increased tariffs in Q1, shippers should anticipate a strategic pull-forward of inventory out of Asia, which would affect both international and certain domestic freight markets (e.g., Southern California).

Changes in zero-emissions vehicle (ZEV) standards may lead to challenges in meeting voluntary sustainability goals if ZEVs and supporting infrastructure are unavailable at scale in the marketplace. Conflicting federal and state mandates may create compliance challenges.

An additional focus is likely to be trade diversion compliance, especially across the U.S.-Mexico border. Supply chain professionals should maintain meticulous records on suppliers and potentially conduct internal compliance audits to prepare for additional oversight regarding proper documentation of country of origin.

The administration will review the U.S.-Mexico-Canada Agreement (USMCA) in 2026. Opposing pressures from the business and populist labour communities may make the USMCA review a volatile process.

While the Trump administration may be able to shape policy in the ways described above, control of the U.S. House and Senate will directly affect the next highway, transportation and infrastructure bill.

Underlying these supply chain specific policies will be broad debates in Congress regarding the expiration of the Tax Cuts and Jobs Act that could affect overall economic demand in both the domestic and international freight markets.

A timeline of important policy milestones for supply chain professionals is below.