Tariff tensions and rate uncertainty define Q4 ocean trade

Published: Thursday, November 06, 2025 | 08:00 AM CDT

Onthispage

Asia

Global trends

For Asia’s ocean export markets, rates are strengthening across key trade lanes as carriers carefully manage capacity following Golden Week. The demand rebound after the holiday was stronger than expected, driven by cargo rolling and front-loading before anticipated increases in U.S. tariffs. This momentum supported rate increases announced for 1 November.

On the Trans-Pacific lane, carriers have progressively reinstated capacity, while maintaining tight control over available space. Rate increases took effect 1 November, with United States West Coast (USWC), intermodal point intermodal (IPI) and reverse intermodal point intermodal (RIPI) rates holding. United States East Coast (USEC) rates show varied implementation as market conditions adjust. The sustainability of these higher rates remains uncertain, as additional vessel capacity is expected in the coming months.

Uncertainty over scheduled and threatened U.S. tariff increases on Chinese goods for November prompted some shippers to move cargo earlier than usual. But export volumes are expected to rise gradually toward the end of November as shippers position inventory for post-holiday retail replenishment.

Regional highlights

Asia to North America

Forecast: Rates are expected to remain elevated. Vessel utilisation is projected to stay healthy, while volumes could rise if shippers advance cargo to mitigate potential tariff impacts.

Market dynamics: Following the Golden Week holiday, carriers have gradually reinstated Trans-Pacific capacity while carefully managing vessel availability to align with current demand and support higher rates. A mid-October rate increase was followed by an additional hike on 1 November. USWC, IPI and RIPI rates are holding at elevated levels, while USEC rates show more varied implementation as the market adjusts.

The durability of these increases is uncertain, as more vessel capacity is expected to enter the market in the coming months, potentially placing downward pressure on rates if demand does not strengthen correspondingly.

Potential future tariff changes are influencing shipper behaviour, with some advancing cargo to avoid higher costs. This has created short-term volume spikes, though booking activity may soften afterward. Vessel utilisation remains healthy for now, but the balance between expanding capacity and underlying demand will determine rate stability through the remainder of the year.

Asia to Europe

Forecast: Spot rates are expected to rise in early November. Export volumes are likely to pick up gradually toward late November as retailers replenish inventory for the post-holiday period.

Market dynamics: Spot rates increased in late October as carriers managed vessel space to match demand—a practice known as capacity discipline—which helps prevent an oversupply that could depress rates. A new round of rate increases took effect on 1 November, though their sustainability remains uncertain with new vessel deliveries scheduled before year end.

Early signs of demand recovery are emerging, driven by shippers restocking inventory ahead of post-holiday retail activity. This gradual increase in export volumes is supporting healthy vessel utilisation on Asia-to-Europe routes. However, with capacity expanding and demand improving only moderately, sustaining elevated rates will depend on carriers’ continued ability to align supply with cargo demand in the coming weeks.

Key takeaways

Monitor whether the rate increases stick in the coming months, as additional capacity may put downward pressure on rates. Securing space early and considering fixed-rate agreements can help to manage exposure to spot market volatility.

Shippers should also account for potential tariff-driven shifts in delivery timing, which could create short-term capacity constraints. Gradual volume recovery is expected toward the end of November as retail activity ramps up, so careful planning of lead times for inventory positioning remains essential.

North America

Global trends

Trade tensions between the United States and China have been affecting North American ocean exports, driving shifts in carrier operations and capacity deployment. In mid-October, China announced retaliatory port fees on U.S.-flagged and partially U.S.-owned vessels calling Chinese ports, mirroring U.S. penalties on Chinese vessels that started 14 October. A deal announced in writing on 1 November suspends these port fees for a year starting 10 November.

Analysis suggests fees payable by Chinese operators could have reached $1.15 billion in the first year, compared with $180 million for American operators. Carriers have been absorbing initial costs while reorganising fleets to minimise exposure.

U.S. import volumes are forecast to decline 19.7% in November and 20.1% in December, bringing the full year to 24.7 million 20-feet equivalent units (TEUs), down 3.4% from 25.5 million TEUs in 2024. The Canadian ocean import market is also contending with this complex trade environment. Overall demand may remain soft across key lanes and the outlook is for steadily declining import volumes, attributed to front-loading in Q2 and Q3 and a general slowdown in consumer demand.

Despite this decline, consumer spending remains resilient, with Americans expected to spend $890.49 per person on holiday gifts, food and decorations—the second highest in 23 years, only 1.3% below last year’s record.

Global schedule reliability

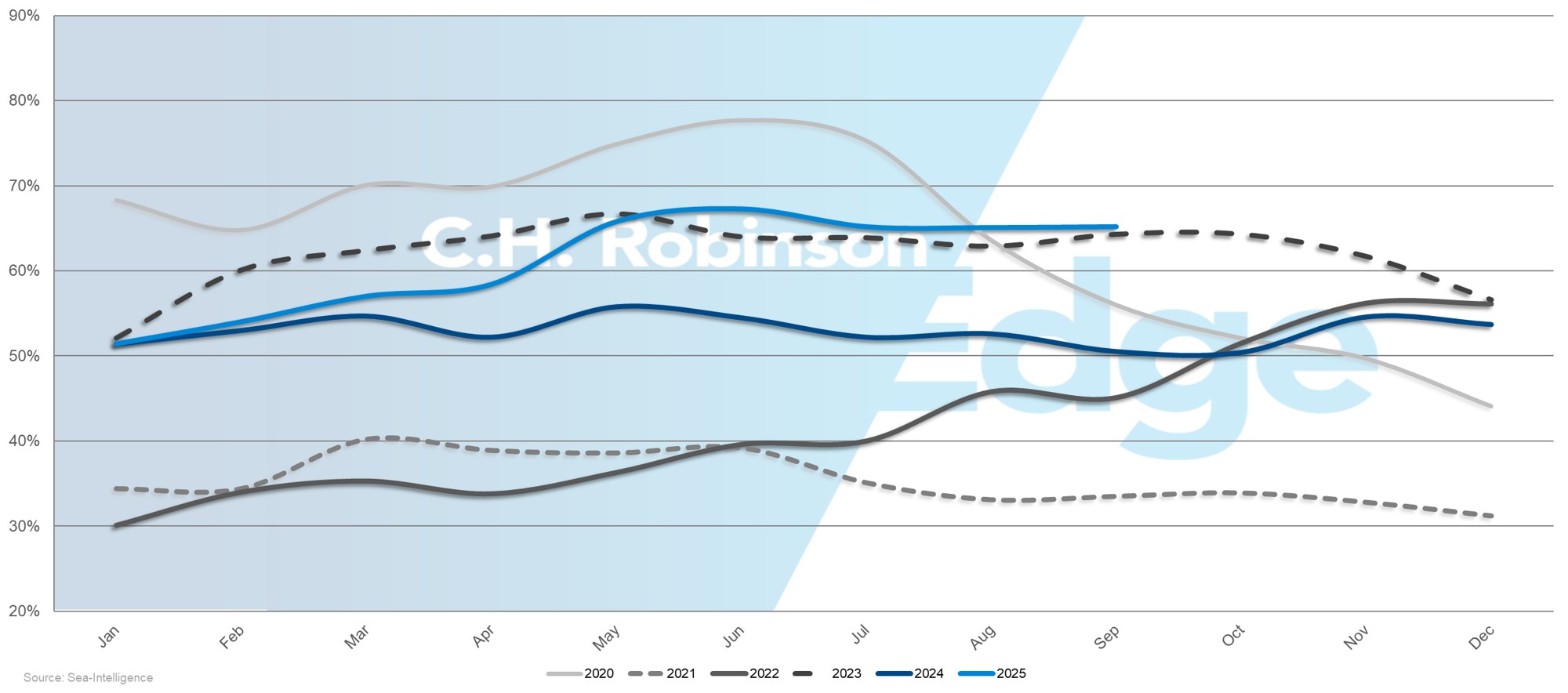

Global schedule reliability improved to 65.2% in September 2025, up 14.7 percentage points year-over-year, though average delays for late arrivals remained at 4.88 days. The modest improvement reflects ongoing efforts by carriers to stabilise schedules despite persistent congestion at key global hubs, with North American trade lanes experiencing similar reliability challenges as carriers balance capacity across multiple regions.

Regional highlights

North America to Asia

Forecast: Capacity is expected to tighten as carriers implement blank sailings in response to softening demand. Space to Southeast Asia will be more constrained than to North Asia.

Market dynamics: Softening demand on the Trans-Pacific eastbound (TPEB) lanes from Asia to North America has led carriers to implement blank sailings. Because vessels operate in round-trip cycles, these eastbound cancellations also reduce westbound capacity available for U.S. exporters delivering to Asia. While the threatened 1 November tariff escalation was averted, trade policy volatility continues to complicate fleet deployment and cost management for carriers.

Congestion at major Asian transshipment hubs such as Singapore and Port Klang is limiting available space, particularly for Southeast Asia. The delays stem from vessel bunching after Golden Week and longer port stays caused by equipment repositioning and increased feeder demand, making Southeast Asia services tighter than North Asia. The combination of lower demand, trade policy shifts and port bottlenecks is creating a more constrained and unpredictable environment for shippers as year end approaches.

North America to Europe

Forecast: Space is expected to remain very tight. Congestion is likely to persist for the foreseeable future, with the most significant constraints affecting U.S. Gulf Coast (USGC) exports.

Market dynamics: Ongoing congestion at major European ports limits the volume of cargo that can be handled efficiently, reducing effective capacity despite available vessels. Structural challenges—such as port infrastructure, berth availability and labour actions at Antwerp and Rotterdam—are prolonging turnaround times and slowing transit.

USGC origins are particularly constrained due to insufficient sailings and vessel capacity relative to export demand. These factors collectively maintain tight capacity across key European lanes, underscoring the need for shippers to consider planning bookings well in advance and provide accurate forecasts to secure space through the end of the year.

North America to South Asia, Middle East, Africa

Forecast: Service options are expected to expand in November and into December, with Ocean Network Express (ONE) adding Jebel Ali this month. Rates are likely to remain elevated, with transshipment delays expected to continue. Space availability to India will remain adequate but could be affected by blank sailings. Capacity to Pakistan and Bangladesh will stay tight through year end, with most carriers continuing to serve Pakistan via transshipment.

Market dynamics: More carriers are entering the market, easing earlier capacity constraints and improving routeing options and schedule reliability. However, some carrier suspensions and ongoing transshipment hub congestion—including western Mediterranean ports, Jebel Ali, Abu Dhabi, Mundra and Colombo—are constraining effective capacity and contributing to delays. Rates remain elevated as most carriers continue avoiding the Suez Canal and Red Sea due to security concerns, operating longer alternative routes via the Cape of Good Hope.

Trade imbalances are affecting space allocation: India has more available capacity, but blank sailings are used to manage weak inbound demand following recent tariff changes. Capacity to Pakistan and Bangladesh is constrained because most services rely on transshipment rather than direct calls, with Mediterranean Delivery Company (MSC) currently the only direct U.S. East Coast-to-Pakistan service. These imbalances continue to challenge carriers’ schedule reliability and network efficiency.

North America to South America

Forecast: Schedule reliability is expected to remain at around 80% for the remainder of the year. ZIM’s relocation of its main transshipment hub from Kingston, Jamaica, to Cartagena, Colombia, will alter transshipment patterns. The low-water surcharge for Manaus has been postponed until November.

Market dynamics: Overall schedule reliability remains solid, despite a slight 1.3% dip from last month. Direct sailings remain more reliable because they make fewer port calls and avoid congested transshipment hubs. In contrast, indirect services that rely on hub connections are experiencing greater delays and schedule disruptions. ZIM’s hub shift to Cartagena aims to optimise vessel operations and improve regional cargo connectivity, though it may affect transit times and routeing patterns in the short term.

The low-water surcharge for Manaus, originally expected in October, has been delayed as river levels remain manageable. Carriers continue to operate using specialised barges, but shippers should monitor water levels, as the surcharge could still be applied later in the season.

North America to Oceania

Forecast: High season will continue through the end of the year. Space from the USWC will remain moderately tight, while rates from the USEC remain competitive.

Market dynamics: Though the market is in high season, demand has been lower than usual. USWC origins are experiencing moderately tight space due to blank sailings temporarily reducing available vessel capacity, whereas the USEC maintains full-service schedules, providing more flexibility and easing space constraints.

Brown marmorated stink bug season, which began 1 September based on vessel on-board dates, requires fumigation for susceptible cargo. Currently, no approved fumigators operate in New York, making Philadelphia and Baltimore the preferred alternatives. New Zealand-destined deliveries must also be fumigated at origin, adding further operational requirements for shippers.

Canada

Forecast: Import volumes to Canada are expected to steadily decline through November. TPEB rates will likely hold at elevated levels. Trans-Atlantic and Indian subcontinent rates and demand will likely remain stable. Carriers will continue implementing blank sailings to stabilise vessel utilisation.

Market dynamics: TPEB rates have climbed since mid-October, reinforced by a GRI implemented on 1 November. The rise reflects reduced vessel capacity following China’s Golden Week and a modest uptick in demand as shippers advanced cargo ahead of potential U.S. tariff hikes on China. In contrast, Trans-Atlantic and Indian subcontinent markets remain stable in both rates and demand.

Overall import volumes are softer than expected, as much of the earlier demand was frontloaded in the second and third quarters in anticipation of tariff changes. This earlier surge contributed to temporary port congestion, which is still working through the system. To maintain utilisation and pricing stability amid softer demand, carriers are deploying blank sailings and closely managing capacity.

Key takeaways

Shippers should monitor potential impacts from the interim trade deal with China announced 1 November. For Europe-bound deliveries, providing advance volume forecasts is essential to secure space, particularly from USGC origins where capacity is most constrained. In the Middle East, expanded carrier options, including ONE entering in November, offer more routeing flexibility, but transshipment delays and elevated rates are likely to continue as carriers avoid the Red Sea and maintain diversions via the Cape of Good Hope.

For Oceania, shippers should leverage capacity from the USEC and ensure compliance with stinkbug fumigation requirements, including mandatory origin fumigation for New Zealand-bound cargo.

For Canadian importers, anticipate steadily declining import volumes through November. Work closely with carriers and forwarders to navigate blank sailings.

Across all regions, early bookings, accurate forecasts and proactive scheduling are critical to managing capacity constraints, maintaining reliable transit and controlling costs through year end.

Europe

Global trends

European ocean markets are contending with a challenging operational landscape marked by ongoing port congestion, intermittent labour disruptions and contrasting trends between import and export trades. Northern European ports remain heavily congested, though recent labour actions in Belgium and the Netherlands have been resolved or paused.

The Trans-Atlantic westbound (TAWB) trade is under pressure as softening demand and increased vessel capacity shift conditions in favour of shippers. Meanwhile, Asia-Europe import lanes are seeing rate fluctuations as carriers adjust capacity ahead of tender season.

Bunker fuel prices remain unstable, as uncertainty around Russian oil supply and signs of a global surplus continue to push costs lower.

Regional highlights

Europe to Asia

Forecast: Rates are expected to remain at historically low levels through the remainder of the year. Space is widely available across all major carriers, with short lead times for bookings.

Market dynamics: Europe to Asia export rates remain at record lows, presenting favourable opportunities for shippers to move cargo at very competitive rates. Space availability across carriers continues to support flexible scheduling and short booking windows. Weak demand on this backhaul trade is keeping conditions favourable for shippers across both spot and contract markets.

Europe to North America

Forecast: TAWB rates are expected to remain stable at current low levels through the end of the year. Softer demand continues to limit opportunities for rate increases and space remains widely available across all major carriers. Some carriers may attempt to introduce emergency surcharges tied to recent strike-related costs, but overall market conditions make broad adoption unlikely.

Market dynamics: The TAWB market continues to see historically low rates, driven by reduced demand and ample capacity. Spot rates from Rotterdam to New York are now at their lowest point since pre-pandemic levels (excluding the brief dip in 2023). As of September 2025, year-over-year demand has decreased, with delivery volumes lower than the same period last year. With space open on most carriers and lanes, shippers are benefiting from a favourable booking environment and competitive long-term contract options.

Recent labour actions at Antwerp and Rotterdam have ended or been temporarily paused, though congestion persists, currently averaging two to four days at Antwerp and two to eight days at Rotterdam. Evergreen and CMA CGM have announced emergency surcharges for November to recover costs tied to these disruptions; but weak market conditions are likely to limit their effectiveness.

Europe to South America

Forecast: Rates are expected to remain stable. Space is available across both South America East Coast and West Coast trades, with sufficient capacity to meet demand.

Market dynamics: Europe to South America market remains steady, supported by balanced supply and demand across key trade lanes. Carriers continue to manage capacity effectively, keeping rates consistent and service levels reliable. These conditions provide shippers with a stable and predictable environment for planning upcoming cargo movements.

Europe to Oceania

Forecast: Rates are expected to remain stable. Space is generally available across carriers with short lead times for bookings.

Market dynamics: The Europe to Oceania trade continues to operate under steady market conditions, with balanced capacity and consistent carrier performance. Booking space remains widely accessible, giving shippers flexibility to plan and book cargo with relatively short lead times.

Key takeaways

For TAWB deliveries, take advantage of the current shipper-favourable market with ample space and historically low rates. Build additional buffer time into planning to offset congestion, as vessel wait times at major northern European ports range from two to eight days.

For Asia to Europe imports, expect continued rate volatility as carriers manage capacity discipline heading into tender season. Rate trends will depend on capacity utilisation—monitor closely for potential downward adjustments if utilisation weakens. Plan inventory positioning ahead of the next demand surge prior to Chinese New Year on 17 February, 2026.

Shippers moving cargo from Europe to Asia, Latin America and Oceania can capitalise on stable pricing and dependable service to optimise export planning.

South Asia, Middle East, Africa (SAMA)

Global trends

South Asia, Middle East and Africa ocean export markets are undergoing significant trade policy shifts, particularly on lanes from the Indian subcontinent to North America. Indian exporters continue to face challenges from the 50% U.S. tariff, which has sharply slowed year-over-year export growth since its implementation in August. Labour-intensive sectors such as textiles, gems and jewellery have been most affected.

Relief may be on the horizon, as India and the United States are reportedly nearing a trade agreement that would reduce tariffs on Indian imports from 50% to approximately 15-16%. As part of the discussions, India may also scale back imports of Russian oil and increase its U.S. quota for non-genetically modified corn above the current 0.5 million tons every year.

Lanes from the Indian subcontinent to Europe remain comparatively stable, with steady demand, available space and competitive rates. Carriers are offering targeted spot deals on select sailings, helping sustain balance between supply and demand.

Regional highlights

SAMA to North America

Forecast: Capacity is expected to remain available across all major lanes through November, with equipment accessible at key ports and inland container depots.

Market dynamics: Indian exporters continue to be significantly disrupted by the 50% U.S. tariffs, with labour-intensive sectors such as textiles, gems and jewellery most affected. Textile exports declined nearly 10% year over year in September, following 5% growth in July prior to the tariffs.

From a capacity standpoint, the market remains open, as carriers have deferred planned GRIs and high season surcharges. This deferral reflects moderate demand, but carriers are prepared to activate increases if booking activity accelerates.

Equipment availability is stable across major ports and inland container depots, though carriers continue to monitor utilisation closely and may adjust capacity or pricing in response to demand shifts.

SAMA to Europe

Forecast: Demand is expected to remain steady through the remainder of the year. Service reliability should hold consistent, with space generally available across most services. Rates are likely to stay low, supported by competitive spot offerings from carriers.

Market dynamics: The Indian-subcontinent-to-Europe trade remains stable, with balanced demand and strong service consistency. Unlike the North America lanes, these routes are largely insulated from tariff-related disruptions, supporting predictable cargo flows and reliable scheduling.

Space remains readily available across most services, creating favourable conditions for shippers. Rates continue to stay low as carriers offer selective spot discounts to keep vessel utilisation steady, providing exporters with opportunities to secure capacity at competitive levels.

Key takeaways

Indian subcontinent exporters to North America should closely monitor trade negotiations between India and the United States, as potential tariff reductions could significantly alter market conditions. Plan inventory and delivering strategies with flexibility around the possible timing of a trade agreement to manage costs and avoid stock shortages.

For Europe-bound deliveries, take advantage of steady demand, open space and competitive rate levels by securing spot deals on select sailings while market conditions remain favourable.

South America

Global trends

South America’s export markets are experiencing significant disruption following the introduction of new U.S. tariff policies. The 50% duties on select Brazilian products are reshaping trade flows, with coffee and sugar increasingly redirected from the United States to Europe. This redirection is tightening space on Europe-bound services, contributing to broader regional imbalances.

Globally, capacity conditions remain uneven. Space to Asia is widely available at competitive rates, while Europe-facing services are increasingly constrained, often requiring bookings several weeks in advance. Carriers are responding by rerouting vessels through third-country transshipment hubs such as Cartagena and Panama to mitigate congestion and maintain schedule reliability across long-haul networks.

On the West Coast, weather disruptions in Chile and cut-and-run port operations are testing schedule integrity. Several carriers have paused bookings for up to four weeks on certain routes to Mexico and North America. Meanwhile, Peru and Chile’s peak fruit export season is tightening capacity further, intensifying competition for vessel space through the fourth quarter.

Regional highlights

South America to Asia

Forecast: Capacity is expected to remain open through the remainder of the year. However, Peru and Chile are likely to experience tightening space as the fruit export season advances. Carriers will prioritise 40-feet containers to maximise vessel utilisation. GRIs may be attempted in alignment with Trans-Pacific market trends, though implementation success will depend on overall demand conditions.

Market dynamics: Soft demand continues to create a favourable environment for shippers, with flexible booking options across most trade lanes. Carriers are emphasising 40-feet containers to improve efficiency and vessel loading balance.

Traditional commodity exports are showing mixed performance in early November: paper and wood volumes remain subdued due to weaker global construction and packaging activity, while cotton exports have held steady. Elevated inventory levels in China are prompting some exporters to redirect deliveries toward Bangladesh and India, where spinning mills maintain consistent demand.

Key exports from the South America West Coast (SAWC) currently include citric acid, wood products, metal parts, plastics and foodstuffs. As Peru and Chile move deeper into the peak fruit export season, space demand is expected to tighten sharply, increasing competition for available slots on Asia-bound services.

South America to North America

Forecast: Service patterns are expected to remain disrupted as carriers continue to reroute vessels through Colombia, Mexico, Peru and Canada. Traditional commodity volumes are likely to stay muted, while transshipment delays via Kingston will continue to affect schedule reliability. Congestion at Manzanillo, Mexico, is affecting loading operations, whereas Cartagena, Colombia, is emerging as a more reliable alternative for U.S.-bound cargo.

Market dynamics: U.S. tariffs of 50% on Brazilian goods are disrupting established trade flows. Coffee deliveries to the United States have declined sharply as exporters redirect volumes to Germany, now the leading buyer of Brazilian coffee, while some U.S. importers are sourcing from Colombia instead. Sugar exports to the United States have dropped by more than 80%, prompting shippers to target alternative markets. Meanwhile, wood and tile exporters are pausing new deliveries amid uncertainty over potential U.S. policy changes.

Carriers are rerouting services through third-country transshipment hubs to maintain network coverage and schedule continuity. However, these adjustments come with challenges. Some carriers are struggling to keep schedules on track, resorting to cut-and-run operations—skipping planned port calls to recover time lost from earlier delays.

Adverse weather in Chile has compounded the situation, disrupting loading and berthing windows and further reducing schedule reliability. Peru and Chile are entering their peak fruit export season, driving strong demand and further tightening vessel capacity on North America lanes.

South America to Europe

Forecast: Capacity is expected to remain highly constrained, with bookings often requiring up to four weeks’ lead time. Vessels are sailing at full utilisation and strong demand for coffee and tobacco deliveries is expected to persist through year end.

Market dynamics: Sustained export demand is being driven by several key factors. Coffee exports have risen sharply, with Germany now serving as the leading destination for Brazilian coffee following the introduction of 50% U.S. tariffs on select goods. Tobacco volumes also remain elevated amid typical fourth quarter peak demand. Together, these trends are maintaining high export activity and keeping pressure on already limited vessel capacity.

Carriers such as Mediterranean Delivery Company (MSC), CMA CGM and Ocean Network Express (ONE) are prioritising 40-feet dry containers for lighter cargo, as the ongoing sugar export season continues to absorb much of the available specialised equipment, including 20-feet and bulk containers.

As a result, routeing flexibility remains limited. Port congestion at major European gateways is compounding these challenges, prompting carriers to divert deliveries from London to alternative ports such as Southampton and Felixstowe.

On the Atlantic coast, operational performance at Cartagena has improved significantly. The introduction of new carrier services is positioning the port as an increasingly reliable gateway for Europe-bound cargo.

Key takeaways

South American exporters should adjust their strategies as trade patterns shift. For Asia-bound cargo, take advantage of open capacity and favourable rates, prioritising 40-feet containers where possible. For Europe-bound deliveries, book at least four weeks in advance, as vessels are operating at full capacity. Consider using alternative UK ports such as Southampton or Felixstowe to improve routeing flexibility.

At Brazilian ports, plan for congestion at Santos, Rio de Janeiro, Paranaguá and Itapoá. Consider alternative gateways such as Imbituba, Suape, Pecém or Salvador, where utilisation remains lower. Monitor equipment availability closely—particularly for 20-feet containers during the sugar season—and adjust booking strategies accordingly.

Peru and Chile exporters should plan well in advance for the fourth quarter fruit export season, as high demand will increase competition for vessel space across all trade lanes.

Coffee and tobacco exporters should secure space early, given elevated seasonal volumes and trade flows toward Germany.

Oceania

Global trends

Export markets are moving through the final quarter of 2025 with healthy demand and steady trade activity—conditions expected to extend into early 2026.

Agricultural export volumes are rising as the pulse crop season begins in Queensland and New South Wales, with southern state harvests to follow in January. Pulses such as lentils, chickpeas and beans remain key export commodities for the region and a primary driver of seasonal trade growth. Protein exports continue to strengthen, led by robust Australian lamb and mutton volumes, while New Zealand’s limited herd numbers constrain its export capacity.

Overall, capacity remains open and manageable across most export services, though some tightness is expected to persist on U.S.-bound lanes until additional capacity becomes available in February 2026.

Regional highlights

Oceania to Asia

Forecast: Rates on North Asia lanes are expected to experience mild downward pressure through the end of the year. Strong lamb and mutton exports to China will continue, supported by sufficient carrier capacity across most services.

Market dynamics: Additional carrier capacity and slightly easing demand on North Asia lanes are driving modest rate softening. China remains the primary destination for Australian lamb and mutton, with Australia accounting for about 54% of global exports. Meanwhile, New Zealand’s smaller herd continues to limit its export output, reinforcing steady demand for Australian product.

Oceania to North America

Forecast: Space on services to USEC and USWC is expected to remain limited through the end of the year. Rate levels are likely to hold steady until additional capacity enters the market in February 2026 with the launch of the Eagle service.

Market dynamics: Services to both coasts continue to operate near full capacity, sustaining tight space conditions. The forthcoming Eagle service will introduce weekly sailings, helping to ease these constraints.

Strong demand for Australian lamb and mutton exports—driven by Australia’s expanding market share and reduced output from New Zealand—allows carriers to maintain stable rates while focusing on vessel utilisation and schedule reliability.

Oceania to Europe

Forecast: Rates and capacity are expected to remain stable through year end, with balanced market conditions and manageable space extending into early 2026.

Market dynamics: Steady demand on Europe trade lanes is aligning well with available vessel capacity, supporting consistent service levels and predictable schedules. With volumes and fuel costs holding steady, carriers are maintaining current rate levels, creating a reliable environment for shippers to plan and book deliveries with confidence.

Oceania to South Asia, Middle East and Africa

Forecast: Export volumes are rising with the start of the pulse crop season in Queensland and New South Wales. Space is sufficient and rates are expected to remain stable through the harvest period.

Market dynamics: The pulse crop harvest—centred on lentils, chickpeas and beans—is driving higher export activity to key destinations in the Indian subcontinent and Egypt. This seasonal increase is well anticipated and vessel capacity remains adequate to support the surge. As a result, shippers can expect stable rates and dependable space availability for planned deliveries.

Key takeaways

Oceania exporters can expect stable market conditions through the end of 2025 and into early 2026, supported by consistent demand for agricultural commodities and protein exports.

Space to the USEC and USWC will remain tight until the Eagle service launches in February, so securing bookings early is recommended.

Across all lanes, carriers continue to prioritise service reliability and vessel utilisation, supporting a predictable environment for planning and execution through year end.

Download slides

Download slides