Get ready for produce and construction seasons

U.S. spot market forecast

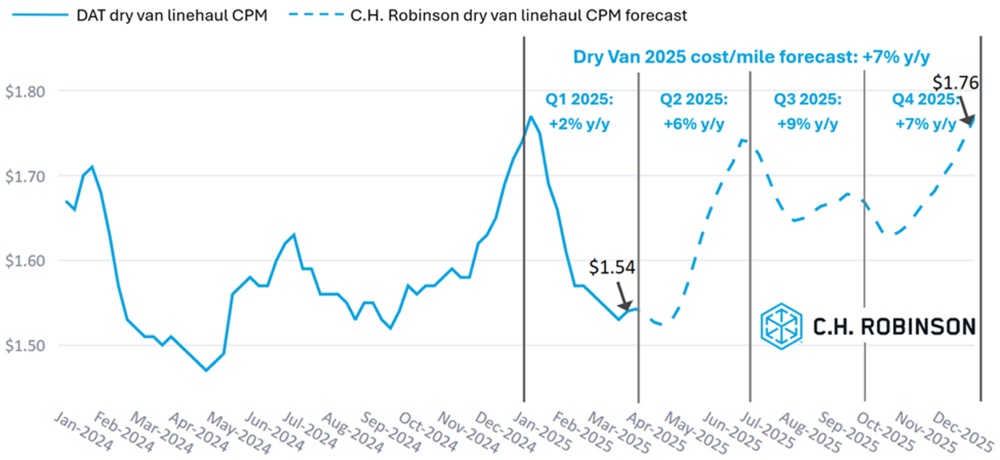

The dry van spot market has continued to soften, aligning with C.H. Robinson’s previous predictions. From a national average perspective, expect pricing to bottom out in April. Regionally speaking, there will be some fluctuations as produce season is in the early stages of ramping up out of Mexico and the southern part of the United States.

The C.H. Robinson 2025 dry van cost per mile forecast remains at +7% year over year (y/y).

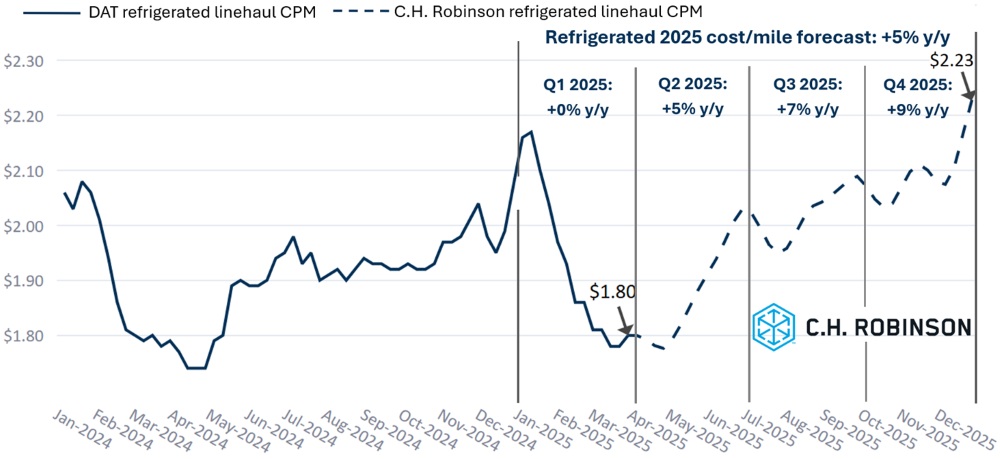

The C.H. Robinson 2025 refrigerated van cost-per-mile forecast remains at +5% y/y.

Contract truckload environment

The following insights are derived from C.H. Robinson Managed Solutions™, which serves a large portfolio of customers across diverse industries.

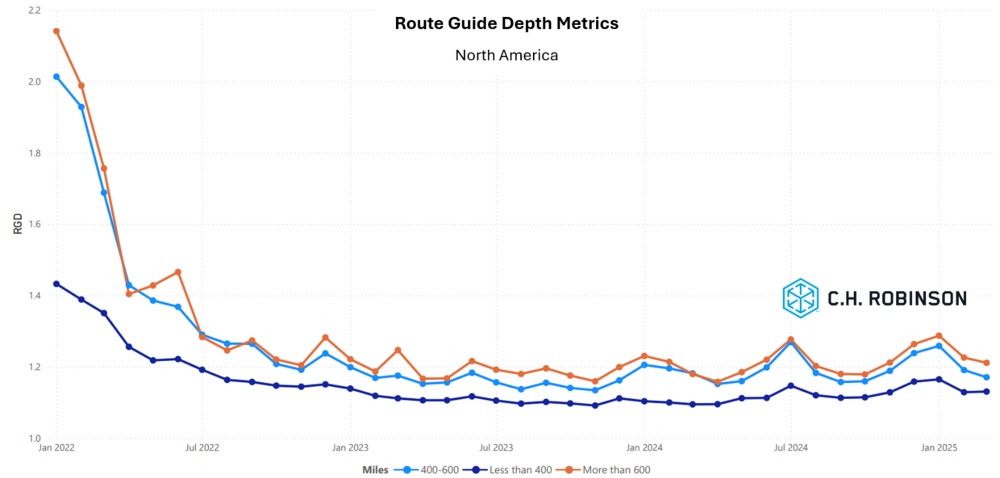

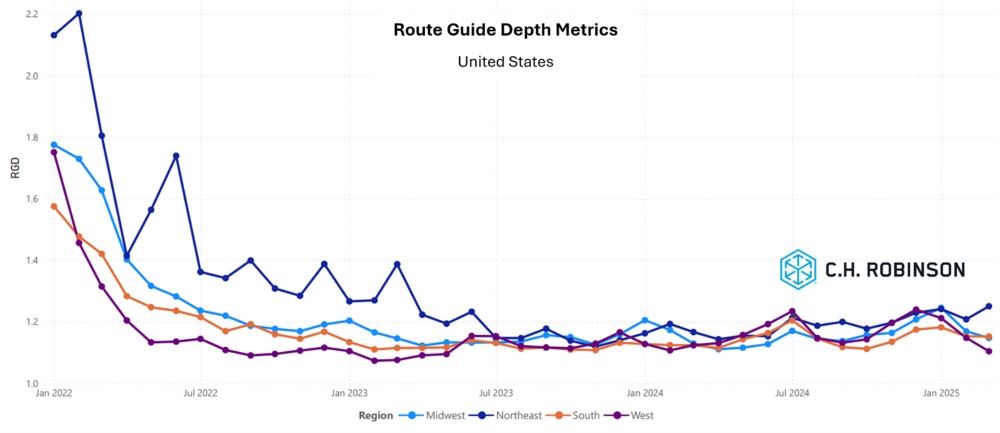

Route guide depth is an indicator of how far a shipper needs to go into their backup strategies when awarded transportation providers reject a tender. Route guide depth of 1 would be perfect performance and 2 would be extremely poor. As displayed in the following chart, route guide depth has remained flat, at a historically low level for approximately two years.

For long hauls of more than 600 miles, route guide depth in March was 1.23, which is slightly better compared to the previous month at 1.29 and slightly worse compared to March 2024, which was at 1.21.

The trend for shorter hauls of less than 400 miles is similar. Route guide depth for March on these shorter hauls was 1.13, which is better than the previous month of 1.16 and slightly worse than March 2024 at 1.10.

Geographically, the southern United States experienced the smallest change of all regions, improving by 2.6% from the previous month, while the U.S. Midwest experienced the largest change, improving by 6.6%. Route guide depth still remains at low levels between 1.14 and 1.21 for all regions.

Refrigerated Truckload

East Coast United States

The East Coast refrigerated market has remained very soft with capacity readily available, in line with seasonal trends. Typical produce season is ramping up, starting out of southern Florida, moving its way into southern Georgia and eventually to the Carolinas in the coming months. Small pockets of produce have started to deliver out of southern Florida already, but not enough to shift the market yet. Expect volumes to truly pick up around mid-April when produce begins to fully ripen.

Central United States

The Midwest temperature-controlled market continues to be relatively soft with capacity available, especially for standard palletised chilled goods with good load/unload times. The outlook for April and May is for more of the same.

Capacity out of the Midsouth is also readily available, although same-day freight may see some tightness. By May, this dynamic will likely shift further. Make loads as attractive as possible to help secure capacity.

West Coast United States

Costs have declined in the refrigerated market on the West Coast due to an excess supply of capacity, aligning with historical first-quarter trends across California, Arizona and the Pacific Northwest. At the end of March, demand began to shift from Yuma, Arizona, to Northern California and may continue to do so in early April.

This could potentially cause short-term rate spikes due to changes in where produce is being harvested, though costs are expected to stabilise as carrier supply adjusts. Meanwhile, outbound freight costs from the Pacific Northwest are likely to remain low, although inbound rates may see increases to offset demand dynamics.

Flatbed truckload

Subtle demand shifts indicate upward momentum

The flatbed freight market is experiencing a notable shift in demand. While the broader truckload market has remained stubbornly soft, recent activity reflects the demand increase in the open deck space. Two key factors driving this increase include energy sector maintenance and seasonal construction activity.

Construction season kicks into gear

While the housing market isn’t experiencing a significant boom, other construction segments are experiencing a rise in demand. Several factors are contributing to this:

Seasonal demand

As temperatures warm, home-improvement projects and commercial construction ramp up, increasing the need for building materials like lumber, steel and roofing materials.

Retail stocking for spring and summer

Home-improvement retailers are stocking up on materials ahead of peak remodeling and DIY seasons, driving increased deliveries to distribution centres and shops.

Infrastructure repair and reconstruction

Insurance payouts from previous storm damage have finally been processed, leading to the start of long-awaited repair and reconstruction projects. This has further driven demand for heavy materials such as concrete, steel and piping.

As a result, flatbed capacity is tightening in regions with high construction activity, particularly in the U.S. Southeast and Midwest, where storm-related repairs and infrastructure projects are most prevalent.

Energy sector planned outages

A lesser-known contributor to the recent increase in flatbed demand has been the planned maintenance cycle in the energy sector. Many refineries and energy plants have entered their routine maintenance period—commonly referred to as outages or turnaround.

While these maintenance periods are scheduled in advance, unexpected replacement needs often arise. This results in a surge of last-minute deliveries for additional parts and materials. These urgent deliveries have been adding stress on top of an already tightening market, particularly in areas with a high concentration of refining and industrial operations, leading to tighter capacity and spot rate increases on critical lanes.

Near-term outlook

While the broader freight market remains in recovery, flatbed freight stands out compared to the other modes. Over the coming weeks and months, expect load-to-truck ratios to level out somewhat. But spot rates will likely continue to increase as the market normalises to the recent changes.

This will vary regionally, with the southern states generally seeing more tightness while the northern states remain relatively steady. For shippers, it has taken only a few weeks for load-to-truck ratios to more than double nationally, so planning ahead will be critical to securing capacity, especially for deliveries coming out of the South.

Voice of the carrier

Market

- Carriers have said the 2025 RFP/bid season anecdotally felt like it was the busiest for them in recent years, but activity slowed in early March as was seasonally expected.

- The market remains volatile, as volumes seem to ebb and flow inconsistently from week to week.

- Carriers continue to look for ways to increase efficiencies by reviewing internal operating costs and optimising lane choices by questioning business with long load/unload times.

Drivers

- Driver labour pools remain full. Carrier confidence to hire drivers quickly if/when needed remains high.

- Retention levels remain comfortable and typical.

Equipment

- Some carriers have expressed a desire to shorten their average length of haul to better accommodate drivers’ desires to be home more frequently, while capitalising on more opportunities in the short-haul market.

- New equipment is plentiful and easily accessible, but costs have increased.

- Maintenance/service repairs remain a variable that has negatively affected utilisation, due to the increasing time it has taken to get parts and for repairs to be completed.